Enhance compliance and onboarding with AI-driven KYC & CDD tools. Streamline fraud prevention and ensure secure identity verification today.

Live KYC monitoring with anomaly detection for advanced AI identity verification.

Streamlines KYC steps for faster, AI-driven onboarding.

Highlights mismatches for thorough checks, enhancing compliance and fraud prevention with AI.

Meets regulatory compliance standards, minimizing risk exposure.

Flags high-risk profiles, accelerating real-time KYC monitoring and review.

Decrease in fraud risk

Reduction in onboarding time

Improvement in compliance efficiency

KYC Just Got Smarter!

Real-time KYC monitoring utilizes anomaly detection and AI identity verification to ensure secure document checks, fraud prevention, and compliance with financial standards.

Streamlines KYC steps, speeding up AI-driven onboarding.

Identifies mismatches, enhancing fraud prevention and compliance checks.

Ensures regulatory compliance, minimizing risk exposure.

Flags high-risk profiles for faster KYC monitoring and review.

AML Done Right, Every Time!

Advanced AML analysis employs real-time alerts and pattern recognition to identify suspicious activities, proactive reporting and thorough due diligence for financial security.

Identifies money laundering patterns instantly to reduce risks.

Examines transactions and spots unusual activities accurately.

Reports AML risks promptly, enabling quick actions and clarity.

Provides insights for investigations, improving financial security measures.

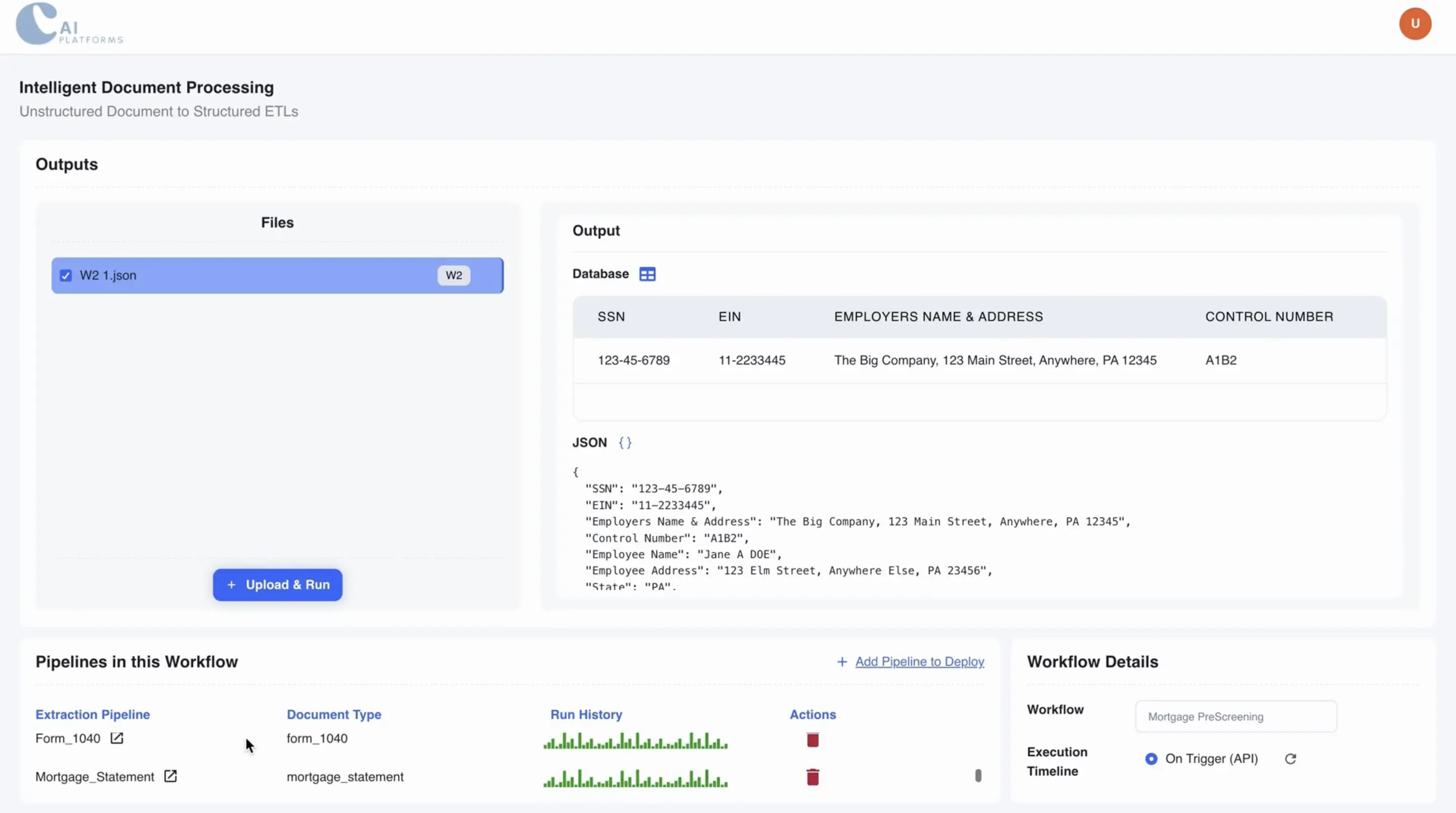

Smart Document Automation

Automated AI data extraction from identity documents enhances KYC & CDD efficiency, minimizing manual errors and safeguarding sensitive information to meet privacy standards.

Extract data from any document type with 99% accuracy using advanced AI algorithms.

Automatically categorize and route documents based on content and type.

Ensure data accuracy with intelligent validation and verification processes.

Accelerates the verification process with real-time data extraction.

Comprehensive KYC, CDD, and AML suite covering all compliance needs.

Real-time alerts enable instant fraud prevention with AI.

Optimization with data-driven insights in financial compliance.

Discover AI-powered solutions revolutionizing finance with automation, fraud prevention, customer insights, and compliance excellence.

Ensure compliance, improve onboarding, and prevent fraud. Take the first step. Book a demo today!