KYC Onboarding is destroying your growth. You know it. Your operations team knows it. Your customers definitely know it.

Every new customer waits 3–7 days for verification. Your compliance team drowns in documents. Support tickets pile up. And half your prospects drop off before you even get started.

What is the main problem? Traditional KYC Workflow systems weren't built for speed. They were built for boxes to check.

According to Gartner’s there’s growing industry momentum toward incorporating AI-driven capabilities and continuous customer verification - signaling that legacy rule-based KYC systems are no longer sufficient for modern financial institutions.

But what if your Customer Onboarding could run itself? What if KYC Processing happened in a few hours?

That’s precisely what Autonomous Agents are doing today.

The average financial services company processes 10,000+ KYC Onboarding checks annually. Each takes 3–5 days. That’s 30,000-50,000 days of collective waiting time.

And when something is unclear, everything stops. An analyst investigates. Days shift into weeks.

Meanwhile, your competitor with fast Automated KYC just signed your prospect.

Forget the hype. See exactly how it matters.

Autonomous agents are AI systems that make decisions, adapt to new scenarios, and handle exceptions without human intervention.

McKinsey’s 2024 Global AI Survey shows that 65% of organizations now use generative AI regularly - up sharply from prior years - underscoring that AI adoption is mainstream in enterprise environments, including compliance and onboarding functions like KYC.

Traditional automation means IF-THIS-THEN-THAT. Autonomous agents are situational intelligence with adaptive logic.

This is why AI Verification radically transforms KYC Processing.

Your KYC Onboarding journey starts with documents: passports, utility bills, corporate filings, and bank statements.

This level of AI Verification removes friction from traditional KYC Workflow models.

Instead of rigid rules, Autonomous Agents evaluate context.

High-risk customer? Automated checks intensify. Low-risk? Fast-tracked through Automated KYC processes.

This ensures both speed and compliance during Customer Onboarding.

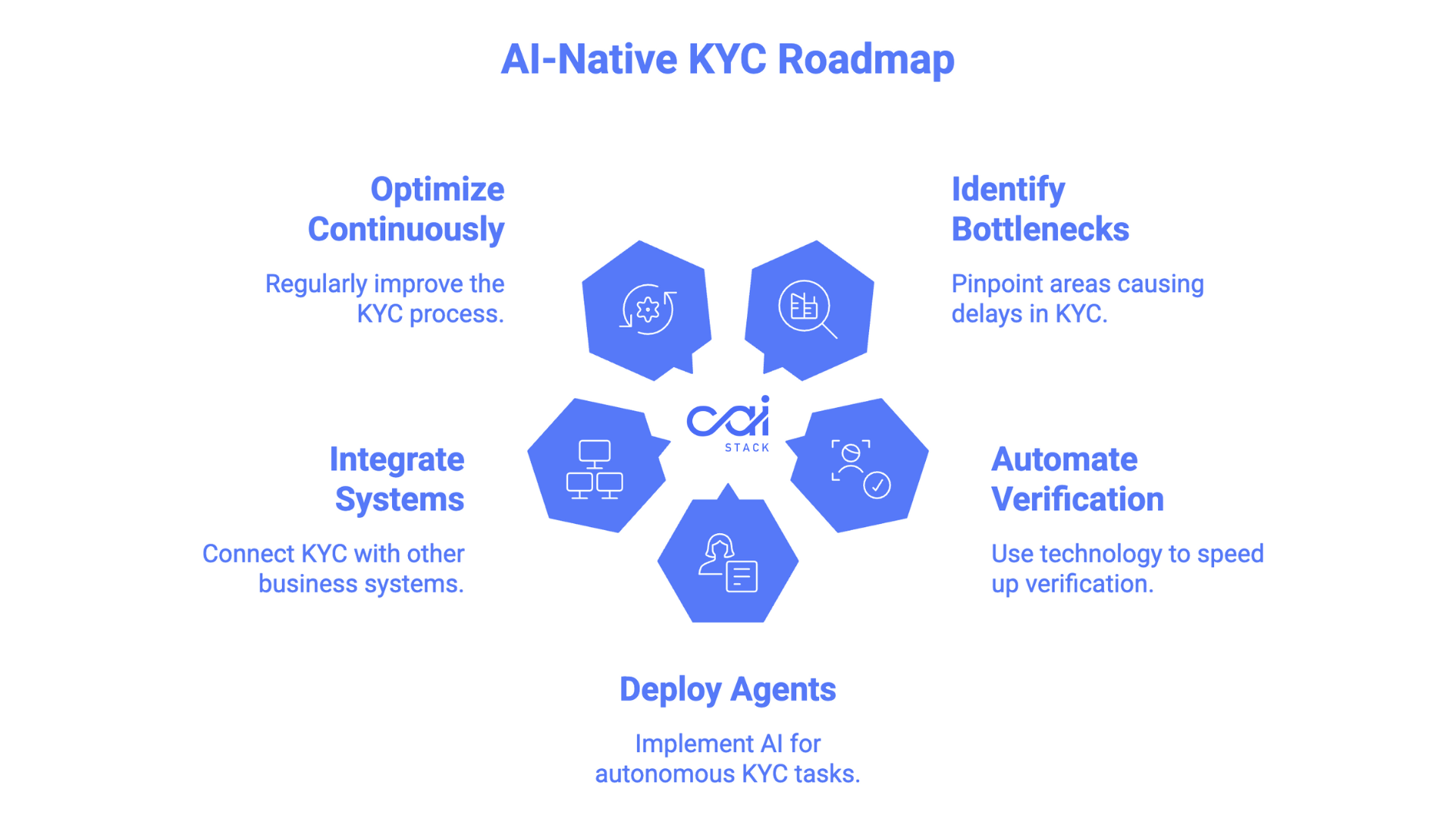

AI-native KYC doesn’t end at onboarding.

This real-time AI Verification ensures safer and more reliable KYC Processing at scale.

CAI Stack builds autonomous-agent systems that reduce KYC processing time by 60-80%. Our solution handles the complexity, so your team can focus on growth and opportunity. See it in action.

Traditional automation breaks on exceptions. Autonomous agents adapt.

Traditional: workflow stops. Autonomous agent: identifies what’s missing, checks alternatives, and continues the KYC Workflow.

Traditional: manual review. Autonomous agent: understands variations - applies contextual AI Verification.

Traditional: delays. Autonomous agent: analyzes bigger risk - supports faster Automated KYC.

This is intelligence - delivered at scale.

If you're evaluating autonomous agents for KYC, here's what matters:

McKinsey’s 2025 report highlights that AI implementation could reduce certain cost categories by as much as 70%, and even after tech investments deliver net cost reductions of 15–20%, demonstrating the economic power of AI automation in operational domains such as KYC and AML.

Fair question. AI verification must meet strict standards.

Modern autonomous agent platforms are built for compliance. They maintain audit trails, document decision logic, and provide explainable AI outputs.

Many regulators now expect AI-enhanced KYC. Manual processes are becoming a risk.

All systems make mistakes. The question is: how often and how costly?

AI-native KYC workflows typically achieve 95-98% accuracy on standard cases. That's better than manual review, which studies show has 80-85% accuracy due to fatigue and inconsistency.

Plus, agents learn from errors. Your team trains them. Accuracy improves over time.

Depends on complexity. Basic automated KYC deployment: 6-12 weeks. Full enterprise rollout: 3-6 months.

Compare that to hiring and training enough analysts to achieve similar throughput. Years, not months.

KYC Onboarding used to be slow and frustrating. With Automated KYC powered by Autonomous Agents, it becomes fast, accurate, and scalable.

Every day you wait, prospects choose faster alternatives. Every month, manual KYC Processing wastes resources and revenue. The future belongs to institutions using AI Verification end-to-end.

CAI Stack specializes in autonomous-agent solutions for KYC. If you're ready to transform Customer Onboarding, let’s talk now.

Subscribe to get the latest updates and trends in AI, automation, and intelligent solutions — directly in your inbox.

Explore our latest blogs for insightful and latest AI trends, industry insights and expert opinions.

Empower your AI journey with our expert consultants, tailored strategies, and innovative solutions.